The United States has formally begun its year-long presidency of the G20 as of December 1, 2025 — a period the government intends to use to highlight economic growth, energy security, technology standards, and global supply-chain reform. (Reuters)

But the opening came at a turbulent moment: global financial markets plunged Tuesday following a steep sell-off in cryptocurrencies and a spike in bond yields, rattling investors worldwide. (Reuters)

📉 Crypto and Bonds Send Shockwaves Through Markets

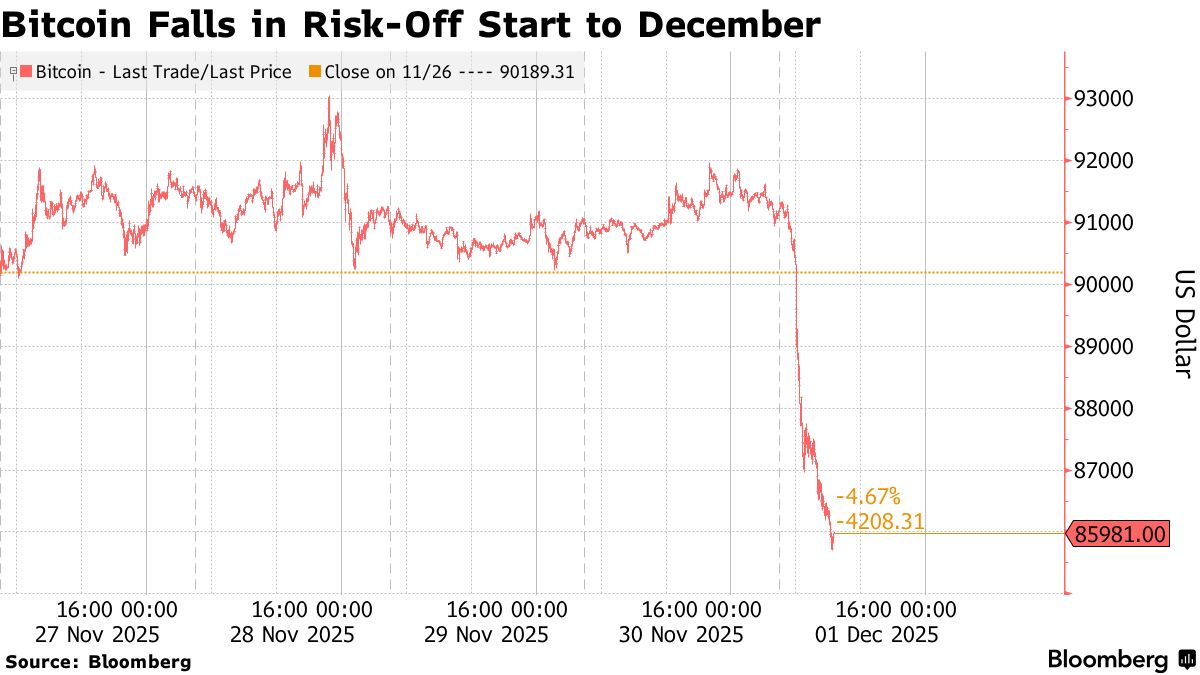

Markets were rocked after a sharp sell-off in both the cryptocurrency and bond markets. According to recent data:

- Global bond yields surged as investors dumped fixed-income assets. (Reuters)

- Bitcoin rebounded slightly after a steep 5.2% drop, but remains down roughly 30% from its October peak. (Reuters)

The turmoil added to investor anxiety, just as the U.S. begins its G20 leadership — hurting risk-sentiment across equities, crypto and bonds alike.

🌐 G20 Goals Under a Cloud of Economic Uncertainty

As G20 President, the U.S. has pledged to focus on:

- boosting global economic growth

- ensuring stable and affordable energy supply chains

- promoting innovation and technology standards across economies (Reuters)

Yet, the timing may prove challenging — with financial markets unsettled and global investors nervously watching central-bank interest-rate decisions. The bond and crypto sell-off raises serious questions about the resilience of global markets ahead of G20-driven policy initiatives.

🔎 What to Watch This Week

- Will volatile markets derail confidence in global growth at the start of U.S. G20 presidency?

- How will central banks — especially in the U.S. and Japan — respond to bond-market tremors and inflation pressures?

- Can the crypto market stabilize or will further sell-off erode retail and institutional investor trust?

- Which G20 economic reforms will gain traction, and can they offset short-term financial instability?